Ethereum is the second-largest cryptocurrency in the world after Bitcoin and has established itself as a leading platform for smart contracts and decentralized applications. The Ethereum price is of great importance to investors, developers, and crypto enthusiasts alike. In this article, we analyze the historical development of the Ethereum price, the most important influencing factors, and provide a forecast for the future.

What is Ethereum?

Ethereum was launched in 2015 by Vitalik Buterin and other co-developers. It is a decentralized blockchain platform that allows the development of smart contracts and decentralized applications (DApps). Ethereum’s native token is called Ether (ETH) , and its price is heavily influenced by market supply and demand.

Historical development of the Ethereum price

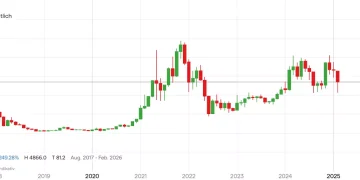

The Beginnings (2015–2017)

Ethereum launched in 2015 with a price of less than $1 per ETH. In the following years, the price experienced a rapid increase, especially in 2017, when the entire crypto market boomed. In January 2017, the price was still around $10, but by December of that year, it had risen to over $1,300 .

The slump and the recovery (2018–2020)

After the highs of 2017, the Ethereum price experienced a sharp decline in 2018. The bear market hit the entire crypto industry, and ETH temporarily fell below $100 . It wasn’t until 2020 that Ethereum began to gain value again, particularly due to the growth in DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) .

The all-time high and current developments (2021–2024)

In 2021, Ethereum reached a new all-time high of over $4,800 . Factors such as increasing interest from institutional investors, the Ethereum 2.0 upgrade process , and the increasing adoption of smart contracts contributed to this growth. However, the price has fluctuated since then due to macroeconomic uncertainties.

Factors influencing the Ethereum price

1. Supply and demand

Like any cryptocurrency, the Ethereum price is determined by the interplay of supply and demand. If more investors buy Ethereum than sell, the price rises, and vice versa.

2. Ethereum 2.0 and technological updates

Ethereum has completed the transition to Ethereum 2.0 with the introduction of Proof-of-Stake (PoS) instead of the previous Proof-of-Work (PoW) . This change has made the network more efficient and could contribute to positive price development in the long term.

3. Regulation and legal provisions

Regulatory decisions by governments around the world significantly influence the Ethereum price. For example, many investors , taking advantage of Cardano’s lower transaction fees and energy-efficient blockchain technology. A ban or stricter control of cryptocurrencies can negatively impact the price, while positive legislative changes can boost investor confidence.

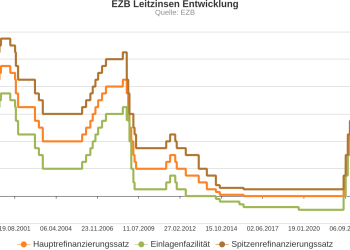

4. Macroeconomic factors

Inflation, central bank interest rate policy, and economic uncertainty also play a role in Ethereum’s price performance. In times of economic uncertainty, investors look for alternative investments such as cryptocurrencies.

5. Development of the DeFi and NFT market

Ethereum is the leading platform for decentralized finance (DeFi) and non-fungible tokens (NFTs) . A rapidly growing DeFi or NFT sector is increasing network usage and thus demand for ETH.

6. Competition from other blockchains

While Ethereum is the most well-known smart contract platform, it has strong competitors such as Binance Smart Chain (BSC), Solana (SOL), and Cardano (ADA) . For example, many investors are taking advantage of Cardano’s lower transaction fees and energy-efficient blockchain technology.

Current Ethereum price and market analysis

Currently, the Ethereum price is [insert current price] US dollars . In recent months, Ethereum has exhibited high volatility due to various market events.

Technical analysis

Ethereum is currently trading in a key support zone of [insert support level] against the US dollar . A breakout above [insert resistance level] against the US dollar could trigger a renewed uptrend.

Fundamental analysis

Ethereum 2.0 has made the network more energy-efficient and opened up new staking opportunities. Large institutional investors are increasingly interested in Ethereum, which could have a positive impact on its price.

Forecast for the future

The long-term future of Ethereum depends on several factors:

- Mass adoption of DeFi and NFTs : If Ethereum maintains its dominant role in these markets, its price could rise in the long term.

- Improvements through Ethereum 2.0 : Scalability and lower transaction fees are crucial aspects for success.

- Enterprise adoption : More companies could use Ethereum for smart contracts and payments.

Short-term forecast

Analysts expect Ethereum to fluctuate between [price range] and the US dollar in the short term . A bullish scenario could push ETH toward a [ higher price target] of the US dollar .

Long-term forecast

In the long term, Ethereum could reach new highs, especially if scalability continues to improve and institutional investors enter the market. Some experts predict prices of $10,000 or more in the coming years.

Conclusion

The Ethereum price depends on many factors and remains volatile. Technological developments, regulatory changes, and market dynamics play a major role. Investors should always stay informed about the latest trends and make an informed decision before investing in Ethereum.

Ethereum remains one of the most promising cryptocurrencies, and with the right strategic adjustments, it could continue to play a leading role in the blockchain sector.